Subscription Fraud Prevention: Safeguarding Your Business and Customers

Subscription-based services models such as Dollar Shave Club and Blue Apron have gained immense popularity among consumers worldwide, and it is projected that by 2023 that approximately 75% of consumer brands will likely provide a subscription-based option. However, this surge in subscription services has also given rise to a concerning trend: subscription fraud. Subscription fraud costs companies billions of dollars each year, with estimates suggesting that the global cost of subscription fraud reached more than $2 billion dollars. In this article, we will explore the impact of subscription fraud and provide practical strategies for effective prevention.

Understanding the Key Challenges of Subscription Fraud

Subscription-based businesses are vulnerable to many forms of fraud, such as the use of stolen or fake credit card information to gain access to services without payment. This vulnerability exists because the recurring nature of subscription payments can provide fraudsters with an ongoing benefit over an extended period. Businesses need fraud prevention measures to protect themselves and their customers. But fighting fraud is not easy for several reasons, including:

- Sophistication of fraudsters: Fraudsters are becoming more sophisticated in their approaches, utilizing advanced technologies and techniques to deceive systems and bypass security measures. To combat this, businesses must employ equally advanced fraud detection and prevention systems capable of detecting and mitigating sophisticated fraud attempts.

- Regulatory compliance: Compliance with industry regulations and standards poses another challenge in preventing subscription fraud. Businesses must ensure they are adhering to applicable regulations, such as those in the United States and Europe.

Four Effective Prevention Strategies for Subscription Fraud

By staying proactive and adopting robust measures, businesses can protect their revenue and maintain customer trust. Here are some examples:

1. Identity Verification

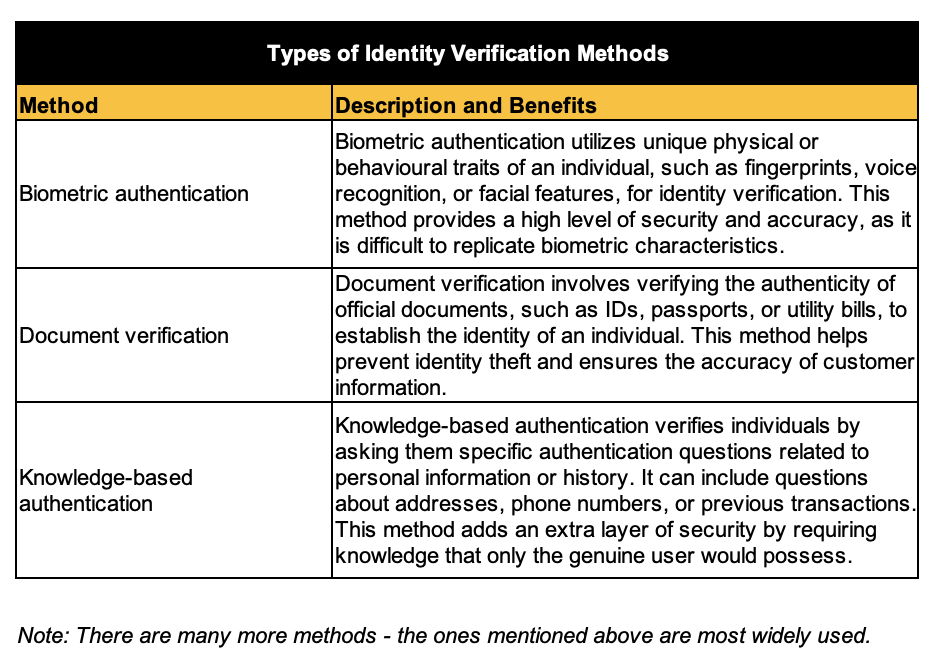

As the name suggests, identity verification processes involve the confirmation of the authenticity of a person’s identity. Identity verification ensures that the person accessing the subscription-based service is who they claim to be. Utilizing technologies such as biometric authentication, document verification, and knowledge-based authentication can improve the accuracy and security of identity verification. A comprehensive identity verification solution combines these methods to safeguard user identities, prevent subscription fraud, and maintain the integrity of the service.

2. Advanced Fraud Detection Systems

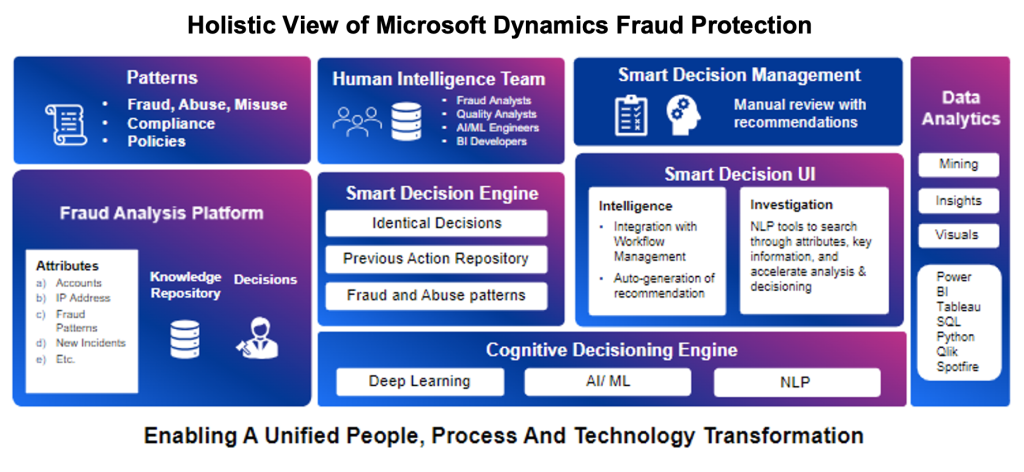

Advanced fraud detection systems leverage data analytics, machine learning, and artificial intelligence to detect patterns and anomalies that indicate fraudulent behavior. Real-time monitoring and analysis of transactional data, user behavior, and device information are essential for identifying and mitigating potential risks. Microsoft Dynamics 365 Fraud Protection is an excellent example of an AI-powered fraud detection and mitigation platform that continuously learns ever-evolving fraud patterns.

3. Behavioral Analysis and Anomaly Detection

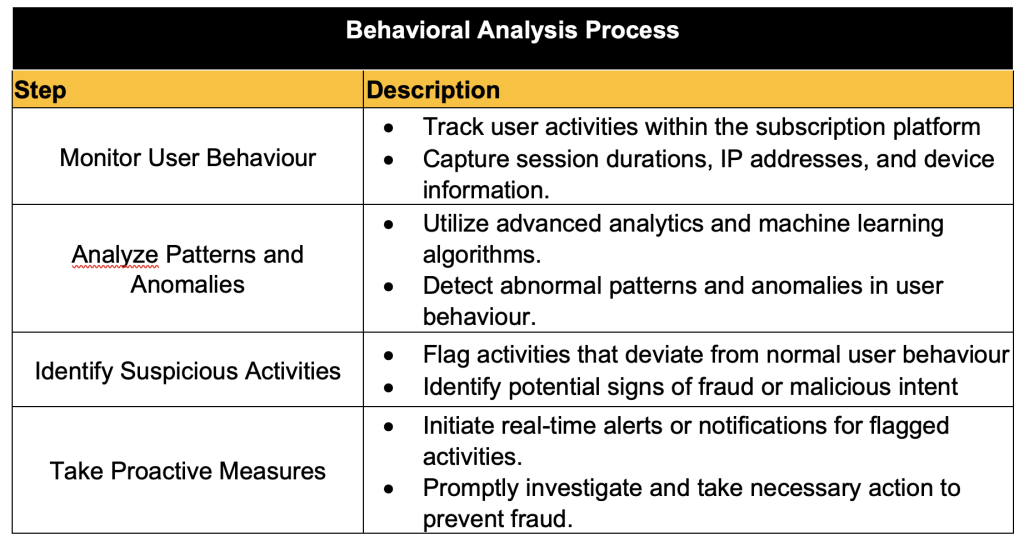

Monitoring user behavior within the subscription platform is crucial for identifying suspicious activities. By analyzing patterns, session durations, IP addresses, and device information, businesses can detect anomalies that may indicate fraudulent behavior. Implementing behavioral analysis techniques and machine learning algorithms can help identify and prevent fraudulent activities before they cause significant harm. A fraud prevention platform like Microsoft Dynamics 365 Fraud Protection can utilize advanced behavioual analysis and anomaly detection algorithms to analyze user behavior, session durations, IP addresses, and device information. By identifying deviations from normal patterns, businesses can proactively detect and prevent fraudulent activities in subscription-based services.

4. Proactive Customer Communication

Educating customers about the risks of subscription fraud, providing guidelines for secure account management, and encouraging them to report any suspicious activity can help create a vigilant customer base. Timely notifications and alerts regarding account activity can also empower customers to take immediate action if they suspect fraudulent behaviour. For example, a customer communication platform enables businesses to proactively engage with customers, sending timely notifications and alerts about account activities to ensure vigilance and report any suspicious activity in subscription-based services.

Shifting to a Proactive, Customer-Centric Approach

At Centific, we understand the unique challenges faced by subscription-based businesses. Our comprehensive fraud prevention solutions, backed by technologies and industry expertise, empower businesses to stay ahead of the challenges. We offer tailored strategies to prevent subscription fraud, mitigate financial losses, and maintain the trust of your valued customers. Learn more about our Digital Safety Solutions.